UPDATE 2-Australia cuts 2015 iron ore, met coal price forecasts

* Australia cuts iron ore, metallurgical price forecasts

* Cites mounting competition to sell into China steel market

* Says many coal mines in the red at prevailing prices (Adds BREE, analyst quotes, details)

By James Regan

SYDNEY, June 25 (Reuters) - Australia revised down its 2015 iron ore and metallurgical coal price forecasts as rising output of two of the country's biggest export earners outstrips demand, raising concerns for mining companies already struggling with shrinking profit margins.

Robust growth in export tonnages meant Australia would still post an 11 percent rise in total export earnings for mineral and energy comodities in 2013-14, the Bureau of Resource and Energy Economics (BREE) said in a quarterly update

.

Analysts warn, though, that Australia's powerful mining industry is facing a prolonged stretch where commodities will fetch prices well below those of the now-defunct mining boom years.

BREE lowered its price forecast for iron ore to an average $94.60 a tonne in 2015 from a previous forecast of $100.80, citing growing competition to sell into China's steel market.

Although steel production in China is forecast to increase in 2015, competition among iron ore exporters to sell their additional production is expected to intensify, it said, while a strong Australian dollar would also drag on local miners.

"This will draw a sharp focus towards managing costs and enhancing productivity in the sector," said Wayne Calder, deputy executive director of BREE.

The warning comes a day after the world's biggest miner, BHP Billiton, said it was looking at more job cuts at its flagship Australian iron ore division as pressure mounts to rein in spending.

The Reserve Bank of Australia cited the drag from lower commodity prices when it kept interest rates at record low of 2.5 percent this month, with the market expecting rates to stay low for many months to come.

BREE's forecast iron ore price for 2015 is just above the current price of $93.30 .IO62-CNI=SI, following a 30 percent price drop this year. However, exports in fiscal 2014/15 were forecast to rise 13 percent to 720.7 million tonnes, BREE said, just below its previous estimate.

Jefferies has cut its earnings estimates for iron ore miners by 5-9 percent below consensus between 2014 and 2016, owing to expectations ore prices will continue to weaken as supply swells.

"This tsunami of supply is still rolling in, and supply growth is likely to be substantial until 2016," it said in a client note.

BREE also forecast a sharp dip in metallurgical coal prices to $118.90 a tonne in 2015, well down on its March forecast of $134.60. It slightly increased its forecast for exports to 180.5 million tonnes in 2014/15, just up on a year earlier.

Commissioning of new coal mines has more than offset lost production from ones that have closed, BREE said, but many producers were unprofitable at prevailing prices.

"This demonstrates the business of mining bulk commodities like coal and iron ore is almost exclusively the domain of big producers, which can benefit from their large economies of scale," said Minelife analyst Gavin Wendt in Sydney. (Additional reporting by Wayne Cole in SYDNEY; Editing by Richard Pullin)

------------------

Definition of the Coking Coal Queensland Index - CCQ©

The CCQ© represents the prompt physical spot market price FOB port in Queensland for premium hard coking coals falling within the following quality parameters using ASTM sampling and testing standards:

Variable Group:

Total Moisture (a.r.): 10%

Ash (a.d.): 9.7%

Sulfur (a.d.): 0.6%

CSR: 70 (Nominal), 67 (Minimum)

Core Group:

CSN: >7

Reflectance (Mean max Refl., Rv %): 1.15 – 1.52

Fluidity (ddpm 100 Plus

Volatiles (a.d.) < 27%

Where “a.r.” means “as received” and “a.d.” means “air dried”.

----------

Transactions, bids, offers, price assessments and two-way markets will be included in the index calculation if: 1) vessel loading is scheduled within 90 days of data submission, 2) the payment is due shortly after vessel loading, 3) the coal quality is within the quality ranges specified above for all four of the “Core Group” measures and/or is considered by the index compilers (as evidenced by the market value of the coal over time) as a premium hard coking coal and 4) the price has been adjusted by the index compiler to account for deviations of quality, loading port and/or standard commercial terms and conditions as described in this document. Prices adjusted quarterly under contracts subject to termination if there is not agreement on quarterly price will also be considered.

Note: Any quality adjustments for sulfur, ash, moisture or CSR will be made according to the guidelines spelled out in the listing of standard commercial terms and conditions below. Any other quality adjustments will be limited to those cases where a history is available that shows a consistent price differential between the coal in question and premium coals as defined in the specs above.

Prices of prompt physical transactions of non-premium hard coking coal products will be included in the CCQ© compilation with appropriate market-based price adjustments for quality, but only after a firm price relationship to premium coals has been established. (No such relationships are known at this time.) Prices of prompt physical transactions of premium hard coking coal products from Port Kembla, Australia and/or Vancouver, Canada will be included in the CCQ© compilation with appropriate market-based price adjustments for ocean freight differentials (if any). Prices of prompt physical transactions of non-premium hard coking coal products from Port Kembla, Australia and/or Vancouver, Canada will be included in the CCQ© compilation with appropriate market-based price adjustments for ocean freight differentials (if any) and quality.

The quality measures (based on ASTM standards for sampling and testing) for Canadian coals considered in the current market to be equivalent to prime Queensland hard coking coals are:

Variable Group:

Total Moisture (a.r.): 10%

Ash (a.d.): 9.7%

Sulfur (a.d.): 0.6%

CSR: 70 (Nominal), 67 (Minimum)

Core Group:

CSN: >6.5

Reflectance (Mean max Refl., Rv %): 1.05 – 1.30

Fluidity (ddpm) 25 Plus

Volatiles (a.d.) < 29%

Where “a.r.” means “as received” and “a.d.” means “air dried”.

· Governing Laboratory Analysis: Quality measurements taken at the vessel loading port will control.

· Demurrage Costs: The shipper will pay demurrage.

· Loading Rates: Vessel loading time will be standard for the port

· Payment Terms: Net payment shall be due within 30 days.

· Standard Ash Adjustment: $1.50 per 1% of ash above 10.0% or below 9.5% per tonne. (A dead band from 9.5% - 10.0%)

· Standard Sulfur Adjustment: $1.50 per 0.1% of sulfur above or below spec per tonne.

· Standard Moisture Adjustment: Price will be adjusted pro rata according to the percent of total moisture in the sample compared to the spec.

· Standard CSR Adjustment: Price will be adjusted according to the difference between the CSR for the coal in question and a nominal 70 CSR based upon historical values of $/CSR Unit. The value per unit of CSR will be based upon a 4-week moving average of the price spread compared to 70 CSR coals for each CSR level. However, this procedure will not be implemented until such time as sufficient actual data are available to establish an average value of the price effect per unit of CSR. In the interim, the adjustment will be $0.60 per percent of CSR plus or minus the nominal value of 70 percent. No coal with CSR less that 68 will be considered.

Note: When physical transactions are presented to index compilers, the participants will be asked whether or not the price reflects normal commercial terms and conditions as set forth in this report. Participants will inform the index compilers of the deviations, if any, and the index compilers will make the appropriate market-based adjustment.

Definition of the Hampton Roads Coking Coal Index–CCH LOW©

The CCH-LOW© represents the prompt physical spot market prices FOB port in Hampton Roads, Virginia for premium low volatile coking coals falling within the following quality parameters (based on ASTM sampling and testing standards):

Variable Group:

Ash (a.d.): 5.5%

Sulfur (a.d.): 0.7%

Total Moisture (a.r.): 8.0%

Core Group:

Volatiles (a.d.): 16 – 19% (See note)

FSI: 7 – 9

CSR: 30+

Mean max Reflectance, Rv %): 1.4 – 1.7

Note : In the case of Blue Creek coals in Alabama, the volatiles can be as high as 20.6%.

Transactions, bids, offers, price assessments and two-way markets will be included in the index calculation if: 1) vessel loading is scheduled within 90 days of data submission, 2) the payment is due shortly after vessel loading, 3) the coal quality is within the quality ranges specified above for all 4 of the core group measures and/or is considered by the index compilers as a premium hard coking coal and 4) the price has been adjusted by the index compiler to account for deviations of quality, loading port and/or standard commercial terms and conditions as described in this document. Prices adjusted quarterly under contracts subject to termination if there is not agreement on quarterly price will also be considered.

Note: Any quality adjustments for sulfur, ash or moisture will be made according to the guidelines spelled out in the listing of standard commercial terms and conditions below. Any other quality adjustments will be limited to those cases where a history is available that shows a consistent price differential between the coal in question and premium coals as defined in the specs above.

Prices of prompt physical transactions of non-premium low vol coking coal products will be included in the CCH-LOW© compilation with appropriate market-based price adjustments for quality, but only after a firm price relationship to premium coals has been established. (No such relationships are known at this time.) Prices of prompt physical transactions of premium coking coal products from Mobile, Alabama, Baltimore, Maryland and New Orleans, Louisiana will be included in the CCH-LOW© compilation with appropriate market-based price adjustments for ocean freight differentials (if any). Prices of prompt physical transactions of non-premium low vol coking coal products from Mobile, Alabama, Baltimore, Maryland and New Orleans, Louisiana will be included in the CCH-LOW© compilation with appropriate market-based price adjustments for ocean freight differentials (if any) and quality.

Index compilers will evaluate price transactions based on the following standard commercial terms and conditions:

· Governing Laboratory Analysis: Quality measurements taken at the vessel loading port will control.

· Demurrage Costs: The shipper will pay demurrage.

· Loading Rates: Vessel loading time will be standard for the port

· Payment Terms: Net payment shall be due within 30 days.

· Standard Ash Adjustment: 3% of the FOB price per 1% of ash above or below spec per tonne.

· Standard Sulfur Adjustment: $1.50 per 0.1% of sulfur above or below spec per tonne.

· Standard Moisture Adjustment: Price will be adjusted pro rata according to the percent of total moisture in the sample compared to the spec.

Note: When physical transactions are presented to index compilers, the participants will be asked whether or not the price reflects normal commercial terms and conditions as set forth in this report. Participants will inform the index compilers of the deviations, if any, and the index compilers will make the appropriate market-based adjustment.

Definition of the Hampton Roads Coking Coal Index–CCH HIGH©

The CCH-HIGH© represents the prompt physical spot market prices FOB port in Hampton Roads, Virginia for premium (Type A) high volatile coking coals falling within the following quality parameters:

Variable Group:

Ash (a.d.): 7.0%

Sulfur (a.d.): 0.9%

Total Moisture: 8.0%

Core Group:

Volatiles (a.d.): 32 - 35%

FSI: 7 – 9

Arnu 240 +

Fluidity (ddpm) >28,000

Mean max Reflectance, Rv %): 1.01 – 1.15

Where “a.r.” means “as received” and “a.d.” means “air dried”.

Transactions, bids, offers, price assessments and two-way markets will be included in the index calculation if: 1) vessel loading is scheduled within 90 days of data submission, 2) the payment is due shortly after vessel loading, 3) the coal quality is within the quality ranges specified above for at least 4 of the 5 core group measures and/or is considered by the index compilers as a premium hard coking coal and 4) the price has been adjusted by the index compiler to account for deviations of quality, loading port and/or standard commercial terms and conditions as described in this document. Prices adjusted quarterly under contracts subject to termination if there is not agreement on quarterly price will also be considered.

Note: Any quality adjustments for sulfur, ash or moisture will be made according to the guidelines spelled out in the listing of standard commercial terms and conditions below. Any other quality adjustments will be limited to those cases where a history is available that shows a consistent price differential between the coal in question and premium coals as defined in the specs above.

Prices of prompt physical transactions of non-premium low vol coking coal products will be included in the CCH-HIGH© compilation with appropriate market-based price adjustments for quality, but only after a firm price relationship to premium coals has been established. (So such relationships are known at this time.) Prices of prompt physical transactions of premium coking coal products from Mobile, Alabama, Baltimore, Maryland and New Orleans, Louisiana will be included in the CCH-HIGH© compilation with appropriate market-based price adjustments for ocean freight differentials (if any). Prices of prompt physical transactions of non-premium low vol coking coal products from Mobile, Alabama, Baltimore, Maryland and New Orleans, Louisiana will be included in the CCH-HIGH© compilation with appropriate market-based price adjustments for ocean freight differentials (if any) and quality. Pricing will be in U.S. dollars per metric tonne.

Index compilers will evaluate price transactions based on the following standard commercial terms and conditions:

· Governing Laboratory Analysis: Quality measurements taken at the vessel loading port will control.

· Demurrage Costs: The shipper will pay demurrage.

· Loading Rates: Vessel loading time will be standard for the port

· Payment Terms: Net payment shall be due within 30 days.

· Standard Ash Adjustment: 3% of the FOB price per 1% of ash above or below spec per tonne.

· Standard Sulfur Adjustment: $1.50 per 0.1% of sulfur above or below spec per tonne.

· Standard Moisture Adjustment: Price will be adjusted pro rata according to the percent of total moisture in the sample compared to the spec.

Note: When physical transactions are presented to index compilers, the participants will be asked whether or not the price reflects normal commercial terms and conditions as set forth in this report. Participants will inform the index compilers of the deviations, if any, and the index compilers will make the appropriate market-based adjustment.

Schedule for Publication of Indexes

Each index figure will be published once each week at the same time. The publication time for the both indexes will be each Friday at 12 noon local Brisbane, Australia time. (This is currently equivalent to 10 p.m. Thursday U.S. east coast time and 2 a.m. Friday in London.)

On those occasions when a public holiday falls on the scheduled publication date, the publication date will move to the day prior to the holiday.

Data Collection

Participation from Price Providers: We will collect price data from coking coal producers, coking coal consumers and coking coal traders and market makers. Participation by providers is at the sole discretion of the index compiler (with oversight from the Advisory Committee.)

Price Submission Deadline: The participants will provide transaction data and/or bids & offers to the index compilers verbally or in writing to Energy Publishing’s Knoxville office no later than 12 noon U.S. east coast time each Thursday for the CCH© data, and to

Energy Publishing’s Brisbane office no later than 4 p.m. Brisbane time each Thursday for the CCQ© data. The index compilers will publish each weekly index at noon on Friday, Brisbane time.

Archiving of Price Data: We will transcribe and archive all verbal responses and archive all written responses. We will also archive written records of all market-based price adjustments for deviations from quality, location and/or standard terms and conditions as defined in this report.

Confirmation of Prompt Transactions: Except as detailed below, price providers will confirm that each submitted transaction is a one-time prompt transaction as defined by this document; is not connected with any past or future transaction; and is without any explicit or implicit obligation beyond the specific prompt transaction in question. The exception to this rule is that quarterly re-pricing of contracts that will end if there is no price agreement will be included in the compilation of data.

---------------

Coking coal prices to bottom in Q4, track China demand uptick in 2015: analyst

Melbourne (Platts)--23Sep2014/348 am EDT/748 GMT

Seaborne coking coal contract prices are seen likely to bottom at $118/mt in the fourth quarter before starting to pick up in 2015 tracking an uptick in China's property market, ANZ's Head of Commodities Research Mark Pervan told the International Mining and Resources Conference in Melbourne Tuesday, September 23.

"We are not going to see a strong recovery story. There is still a lot of supply there and Chinese demand is not going to take off," he said.

"The current spot price is around $113/mt and the current contact is at $120/mt. We expect to see maybe $1-2/mt to be taken off that before we see a bit of recovery in 2015."

Platts assessed Premium Low Vol coking coal unchanged day on day at $123/mt CFR China Tuesday, which equates to $110.50/mt FOB Australia after deducting $12.50/mt for Panamax freight.

Article continues below...

Pervan said the coking coal market was moving back into a more cyclical pattern after an extraordinary peak in 2011 when floods in the Australian state of Queensland impacted more than half of global supply. "The supply response [to the 2011 price peak] is hitting the market now, just as the Chinese market gets softer. It's the classic commodity story -- supply lagging demand by about two years," he said.

"You are at the bottom of the cycle right now, when you are planting the seeds for the next price recovery. [But] we are not seeing replacement production being put in place, we are not seeing new capex going into mines, we are not seeing new investment in coal.

"So, in 2017-18 I suspect we will see a supply squeeze and you could see better prices."

Pervan said China's real estate market, as a pillar industry for steel and thus coking coal demand, was coming off sharply in 2014.

"The Chinese imposed a lot of restrictions on the property market 12 months ago, which is starting to bite now," he said.

"So right now the investor will go short with the property market coming down but I suspect the smart investor looking at the medium to long term can see this is the opportunity to be investing in the market at the bottom of the cycle, with the cycle picking up in two-three years' time."

"The Chinese property market will bottom out in the second quarter of next year. So in regards to steel prices, you have a headwind for the next three-six months when the market is going to be still declining on real estate prices in China, then it will pick up in the second half of next year.

"Coking coal and iron ore prices are likely to start seeing support towards the end of the year on that recovery."

LONGER TERM INDICATORS POSITIVE

In the longer term term, the indicators for the seaborne coking coal market were positive from China and from India, Pervan said.

China's steel sector was increasingly moving towards plate production for consumer products in the southern provinces that relied on imported raw material imports and away from rod production using domestic coking coal in the northeast, he added.

"We [ANZ] are pretty confident that China will become more dependent on imports of both coal and iron ore going forward as they reconfigure their steel industry," he said.

"The next story will be India, but we are not getting too excited as it's certainly off a low base. But it's going to grow; it's going to be positive for coking coal because India has a lot of iron ore and it does not have much coking coal.

"But India needs to build its infrastructure. [So] It's not a simple equation," he added.

----------------

Metallurgical Coal at 6-Year Low as Chinese Demand Slows

By Tim Loh September 25, 2014

The quarterly benchmark price for metallurgical coal dropped to a six-year low, according to Doyle Trading Consultants LLC, amid a slowdown in Chinese demand for the steelmaking ingredient.

Australian coal producers and Japanese steel mills agreed to a fourth-quarter price of $119 a metric ton, down a dollar from the third quarter, Grand Junction, Colorado-based Doyle Trading said in a report yesterday.

Chinese imports in August were 39 percent lower than a year earlier, according to customs data, amid a glut of domestic steel. Iron ore demand is also suffering, with prices at a five-year low.

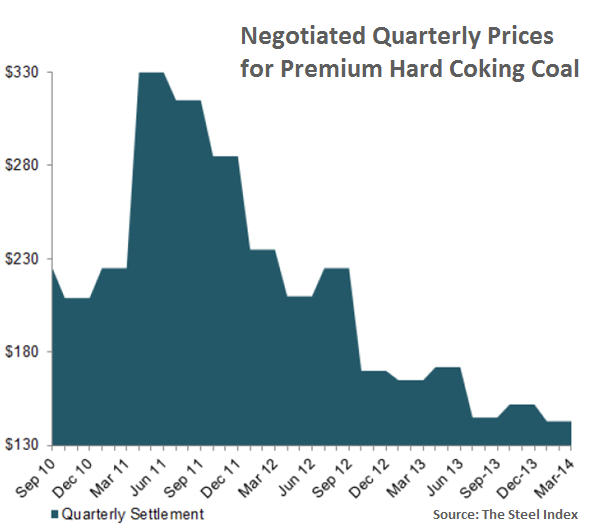

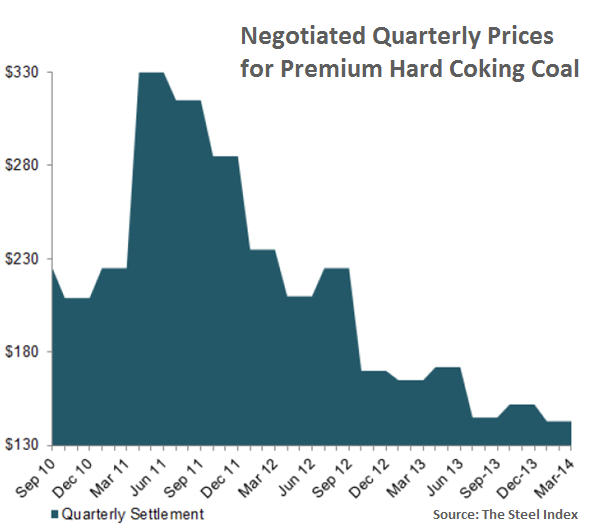

The coal settlement dashes hopes for a rebound in the price, which is down 64 percent since reaching $330 a ton in 2011. U.S. producers will have to continue focusing on cutting costs and potentially idling more unprofitable mines, said Daniel W. Scott, an analyst at Cowen & Co. in New York.

“We expect further met production curtailments to continue into 2015,” Scott said in a note yesterday.

Producers of coking coal, as the commodity is also known, have already announced as much as 30 million tons of production cuts this year, or almost 10 percent of global seaborne supply, St. Louis-based miner Peabody Energy Corp. (BTU:US) said Sept 18.

Shares of U.S. coal producers dropped in New York yesterday. Walter Energy Inc. (WLT:US) declined 4.9 percent to $2.13, its lowest in at least 19 years. Alpha Natural Resources fell 4.7 percent, Arch Coal Inc. (ACI:US) 2.7 percent, Cliffs Natural Resources Inc. (CLF:US) 8.7 percent and Peabody 3.4 percent.

Weaker Aussie

The latest contract price could have fallen to $112 because of a weaker Australian dollar, Doyle said. The fact that it didn’t may reflect concerns a steeper reduction would trigger another round of supply cuts before those already announced had time to take effect, Doyle said.

The “whisper number” for what the settlement would be was closer to $115 a ton, said Jeremy Sussman, an analyst for Clarkson Capital Markets in New York. While the metallurgical coal market is still weak, “the sky is not falling” either, he said in a note yesterday.

The Chinese price for iron ore is at its lowest since September 2009, according to data from Metal Bulletin Ltd. Global output of iron ore will exceed demand by 52 million tons this year and 163 million tons in 2015, according to Goldman Sachs Group Inc.

To contact the reporter on this story: Tim Loh in New York at tloh16@bloomberg.net

To contact the editors responsible for this story: Simon Casey at scasey4@bloomberg.net Will Wade .

----------------

Coking coal price crashes through $100

Australian coking coal export prices fell nearly 4% reaching single digits for the first time since the data have been collected while quarterly contract prices reached six year lows.

Australian coking coal export prices fell nearly 4% reaching single digits for the first time since the data have been collected while quarterly contract prices reached six year lows.

According to data supplied by The SteelIndex spot Australian hard coking coal (FOB Australian east coast exports) price gave up 3.7% on Thursday to $99.50 a tonne, the lowest since January 2013.

The steelmaking raw material is down 16% so far this year. Spot premium coking coal used lost $4.60 or over 4% to $108.20 a tonne, also the lowest on record.

According to a new report by Bureau of Resources and Energy Economics, the Australian government's official forecaster, few miners can operate profitably at these prices.

Today the soft market claimed another casualty with Glencore shutting down its Ravensworth underground mine in Australia.

Steel First quotes a trading source as saying even with prices falling rapidly, potential buyers in China, the world's top importer, are unwilling to commit to seaborne purchases:

People are just sitting on their hands, too scared to commit

"People are just sitting on their hands, too scared to commit," a trading source told Steel First. Buyers are in no rush to purchase material as they are waiting for clearer market cues, he added.

"It's pretty risky to take positions these days, with downstream market weakness. We're not buying unless there is firm demand from customers," another trading source said.

Contract pricing for coking coal has slumped in tandem.

Anglo-American is reported to have settled second quarter contracts with Japan at $120 a tonne. At the same time Indian steel mills according to Bloomberg have inked supply deals at $125 a tonne down 13% from first quarter benchmarks and the lowest since 2008.

Quarterly benchmark coking coal traded as high as $330 a tonne in mid-2011 after bad weather took much of Australia's supply off the market and stayed above $200 for two years between September 2010 and September 2012.

Quarterly benchmark prices is expected to continue to attract a premium of $5 – $10 above spot this year according to BREE forecasts.

Today's met coal price also goes against a long-held rule of thumb in the industry

Today's met coal price also goes against a long-held rule of thumb in the industry – that met coal trades for more than iron ore.

Coking coal's fresh weakness is in contrast the price of iron ore which has regained its footing to trade at $112.30 following an 8% drop in a single day two weeks ago that shook the market.

Only around 25%–30% of the seaborne metallurgical coal trade is sold on a spot basis, but its importance is growing rapidly driven in part by China's increasing dominance as an importer.

China overtook Japan as the world's top importer of coking coal in 2012 and this year is expected to buy 100 million tonnes, mainly from Australia. That compares to 55 million tonnes for Japan and 40 million tonnes for the EU.

While a slowdown in China's steelmaking industry can take much of the blame, surging supply is another factor pushing prices down.

Top producer BMA, a joint venture between BHP Billiton and Japan's Mitsubishi, increased production 22% in the second half of last year and expected to bring on line Caval Ridge (8 million tonnes a year) and Daunia (4.5 million tonnes).

Canada's Teck Resources, Russia Mechel and Cokal in Indonesia all recently embarked on expansion programs, which are now coming on stream.

While many new project may now not see the light of day global supply of met coal is expected to continue to increase in 2014 as top producers seek to achieve lower production costs per tonne of coal sold.

Image of the Pasha Bulker coal carrier that ran aground near Newcastle Australia in

Australian coking coal export prices fell nearly 4% reaching single digits for the first time since the data have been collected while quarterly contract prices reached six year lows.

Australian coking coal export prices fell nearly 4% reaching single digits for the first time since the data have been collected while quarterly contract prices reached six year lows.